Youth Forward Wisconsin is a movement supported by UW-Madison Division of Extension and local Extension educators from 17 Wisconsin communities. This team is providing the tools to understand and implement universal child savings account programs to help Wisconsin youth reach their full potential. The Youth Forward Wisconsin team received an Extension Innovation Grant to support the work […]

On March 1, Chelsea Wunnicke, Human Development and Relationships Educator Richland County, and Jenny Abel, Financial Security Outreach Program Manager, presented expert testimony on universal savings accounts for all children. Wunnicke and Abel shared research-based context at the public hearing for the 2021 Senate Bill 947. The public hearing was with the Assembly Committee on Ways […]

In addition to the resources included throughout this website, the following links are to trusted resources about planning and paying for college. UW-Madison Division of Extension Resources College savings fact sheet (also available in Spanish) – Summarizes the importance of college savings and describes different types of college savings accounts. Savings planning worksheet – Short […]

Although the costs of higher education continue to increase, college graduates enjoy lower unemployment rates and higher earnings. The following chart shows median monthly earnings for U.S. workers in 2021 based on their educational attainment (Source: U.S. Bureau of Labor Statistics). People with a bachelor’s degree earned a median of $1,334 per week or about […]

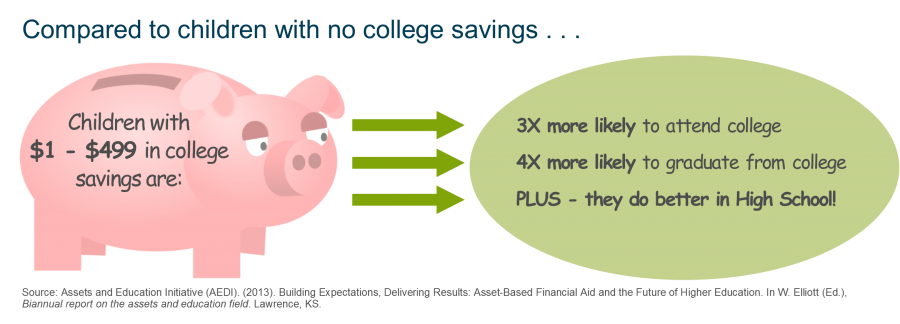

Given how much the cost of college increases over time, saving for your child’s future education may seem like a drop in the bucket. It is true that U.S. households use a variety of sources of money beyond savings to fund their children’s education, but saving for college plays a special role in helping pay […]

Families interested in saving for college have a variety of options over where to save their money, maybe too many options. This page describes some of common options and provides links for more information. The information on this page is provided for educational purposes only and does not imply an endorsement of any specific financial […]